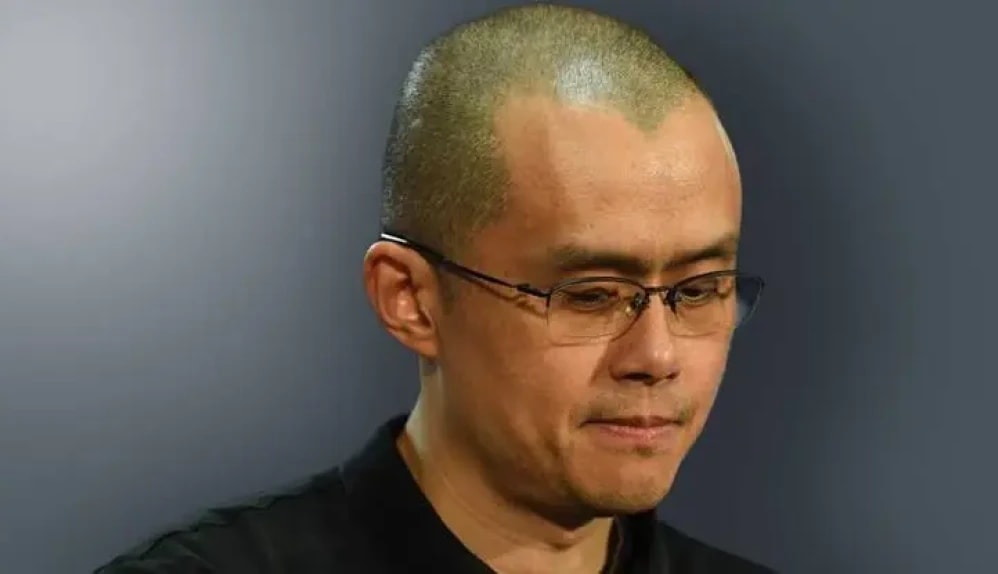

he US Department of Justice (DOJ) filed a scathing sentencing memorandum detailing their case against Binance CEO Changpeng Zhao. They referenced Zhao's own words that his approach was "better to ask forgiveness than permission" when it came to complying with US regulations. The DOJ argued this showed Zhao willfully violated laws to rapidly expand Binance's profits and user base without implementing proper anti-money laundering controls as mandated by the US Bank Secrecy Act.

How Binance Skirted Compliance

Prosecutors said Zhao's actions allowed Binance to operate like the "Wild West" of crypto exchanges. Without adequate know-your-customer processes or transaction monitoring in place, they alleged Binance facilitated over $898 million in transactions that violated US sanctions against countries such as Iran. The DOJ memorandum stated this demonstrated the severity of Zhao's actions, which he knew could result in sanctions-busting activity on the platform.

A Warning to the Crypto Industry

Due to the scale of the violations and Zhao's global prominence as the founder of the largest crypto exchange, prosecutors recommended an unprecedented 36 month prison sentence. They argued this was necessary to appropriately punish Zhao's criminal behavior and also serve as a deterrent to others in the cryptocurrency industry. The DOJ closed by emphasizing this case would send a message not just to Zhao but to the entire world about the seriousness of complying with US financial laws.

The Verdict and Its Implications

Zhao is scheduled to receive the court's final sentencing decision on April 30th. If the recommended three year prison term is upheld, it would deliver a shock to the cryptocurrency sector. The case demonstrates US regulators' willingness to crack down on even the highest profile actors. It warns exchanges must have robust compliance programs or face severe legal consequences. Going forward, cryptocurrency companies may face greater pressure to obey global regulations as the industry continues to mature. This landmark ruling could shape how virtual asset service providers operate internationally for years to come.

This criminal case against Binance's CEO sends a strong signal from US authorities. As cryptocurrency adoption grows, exchanges must ensure legal compliance or risk facing the enforcement actions now being leveled at even the largest industry players. The outcome will resonate far beyond just Zhao or Binance alone.